Deflationary Spiral: China's Consumer Prices Hit 14-Year Low, Economic Worries Mount

China is facing mounting concerns over deflation as consumer prices plunged in January at their sharpest pace in over 14 years, raising alarms about the nation's economic health and its implications for the global economy.

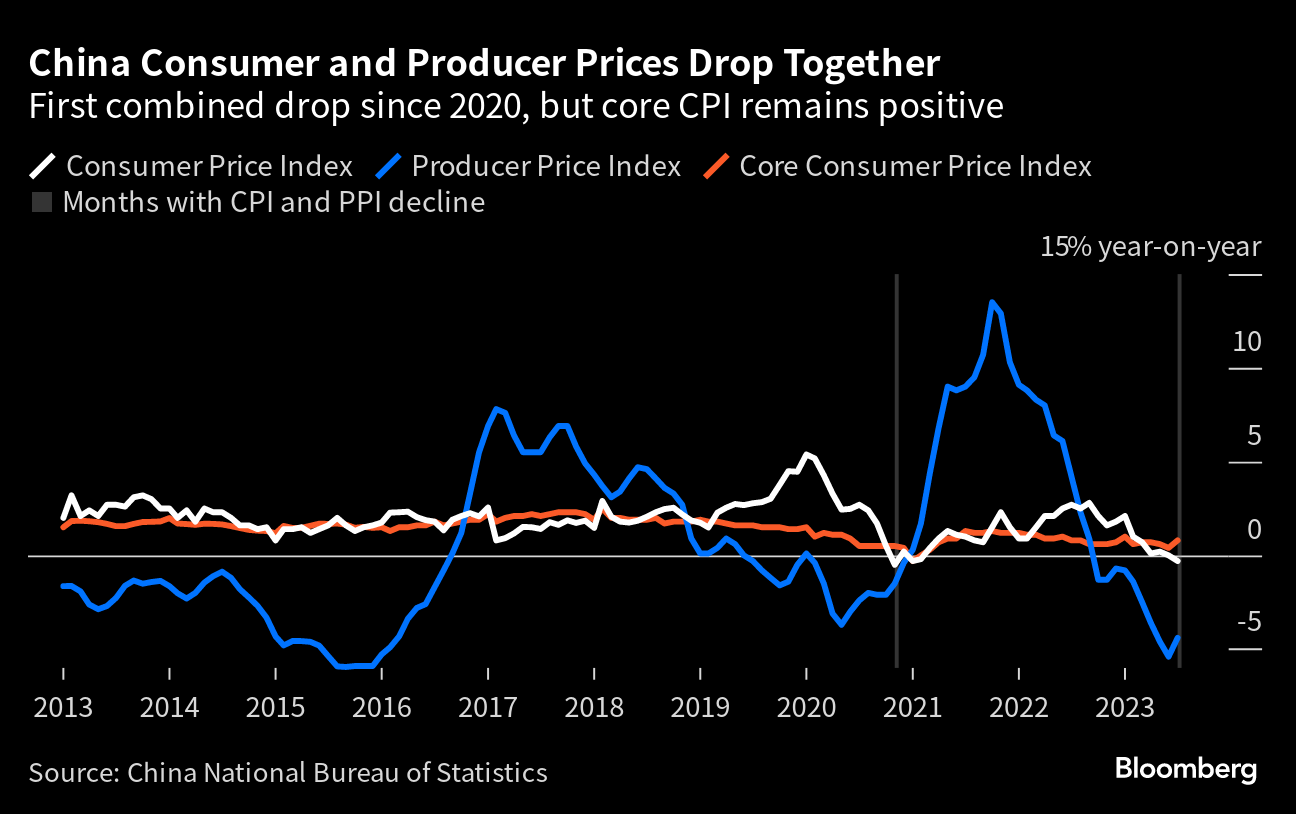

The latest data from the National Bureau of Statistics of China revealed a staggering 0.8% drop in consumer prices compared to the same period last year, surpassing economists' expectations and marking the largest contraction in 15 years. This trend, characterized by nearly continuous price stagnation or decline since July, underscores deepening economic challenges within China.

Persistent caution among consumers, coupled with sluggish spending on everyday goods and property, has contributed to the downward spiral in prices. Income growth has slowed, and high unemployment rates are exerting downward pressure on wages, exacerbating the situation.

Economists warn that prolonged low demand in China could have far-reaching consequences globally, as the country may increasingly rely on demand from other nations to stimulate its economy. Beijing's efforts to offset the downturn in the property sector by bolstering industrial manufacturing, particularly in green technologies like electric vehicles and solar panels, have raised concerns about potential trade tensions.

While the lunar new year holiday, which traditionally boosts spending, fell in January last year, contributing to the year-on-year drop in consumer prices, analysts remain cautious about the broader economic outlook. Food prices, which experienced a significant decline of 5.9% in January, are expected to receive a short-term boost as festivities commence, but underlying economic strains persist.

Unlike previous downturns, Beijing has refrained from implementing a massive stimulus package, opting instead to prioritize "high quality growth" over double-digit acceleration. As policymakers convene for the annual parliamentary meetings in March, all eyes are on the growth targets for 2024, with expectations that they may reflect a new normal for China's economy.

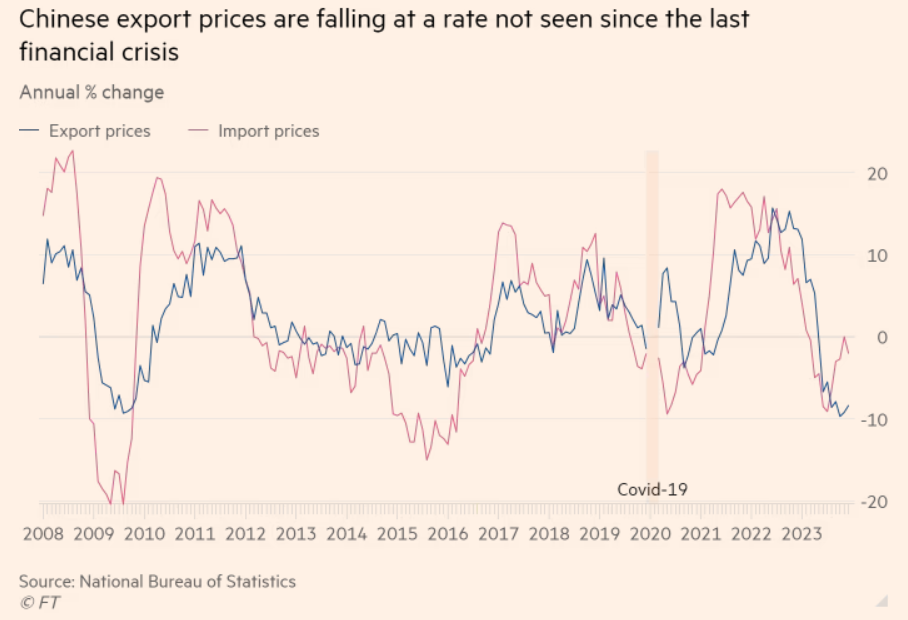

China's economic landscape is poised to exert significant influence on global inflation rates as falling prices in the nation reverberate throughout international markets. With excess capacity in its slowing economy prompting Chinese exporters to slash prices on goods sold abroad, global investors anticipate a downward pressure on inflation rates worldwide.

The prices of Chinese exports have witnessed their most rapid decline since the 2008 financial crisis, signaling that the world's largest exporter is beginning to transmit deflation outward to developed economies. The recent data underscore the transformative impact of China's economic dynamics on global trade patterns and inflationary pressures.

China will be exporting deflation to the rest of the world. This trend could prompt central banks in emerging markets to consider interest rate cuts, particularly in countries with substantial consumption of Chinese goods.

While some economists argue that the impact may be limited, others suggest that the undercounting of US imports from China could amplify the effect on prices.

Moreover, the prospect of cheaper Chinese exports raises concerns among western manufacturers about unfair competition, particularly as China ascends the value-added curve into high-end manufacturing sectors. The recent price cuts announced by BYD, China's leading carmaker, for its electric vehicles in Germany exemplify the intensifying competition in global markets.

As global economic actors navigate the complexities of China's evolving economic landscape, policymakers face difficult decisions regarding import reliance on China and the economic forces driving cheap Chinese supply. However, for many nations, the allure of high-quality products at competitive prices remains irresistible, underscoring China's enduring influence on global trade dynamics.

As China grapples with deflationary pressures and charts a course for economic recovery, the implications for global trade and stability remain paramount, highlighting the need for proactive and strategic measures to navigate uncertain terrain.